Legacy Gifts

Many of our alumnae want to recognise the positive impact of their time at St Anne’s on their lives, and the opportunities it afforded them. One way of doing this is by choosing to leave a gift in your will - one of the most personalised ways you can support your College.

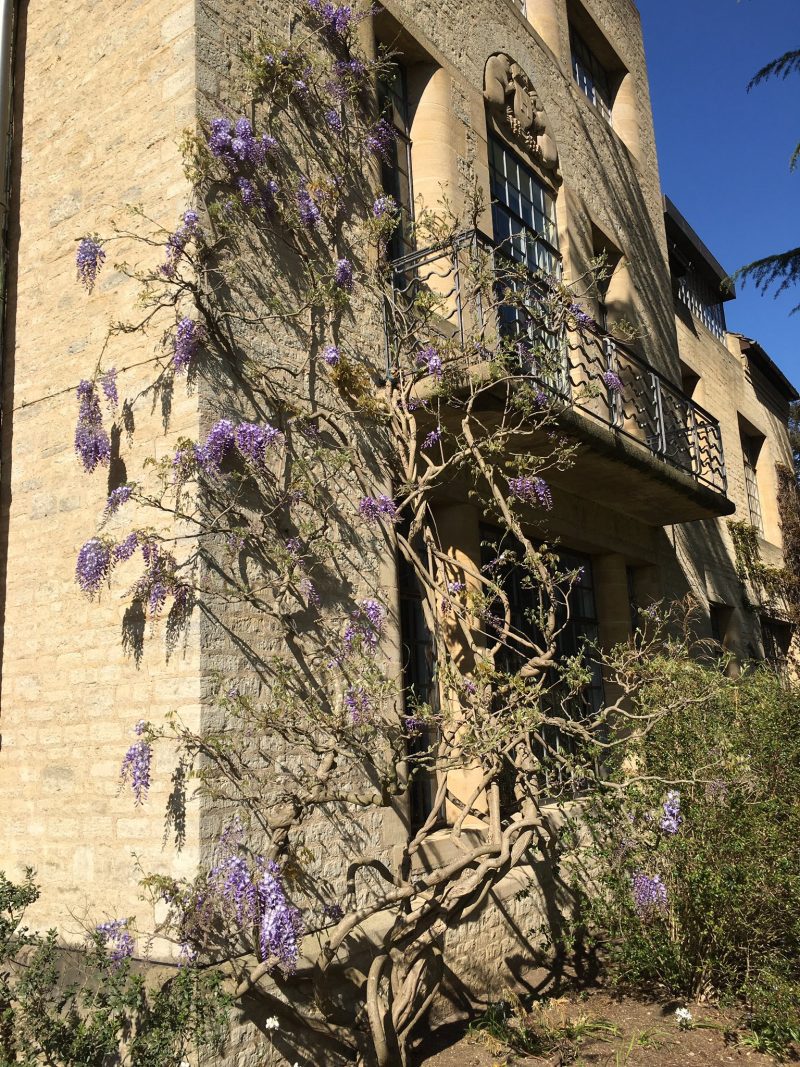

Since our earliest days, legacies have made a vital contribution to students at St Anne’s College, with the

support of earlier generations creating an enduring foundation for the success of future students. Without

the legacy of Amy Hartland, the now-iconic Hartland House, our first purpose-built building, would not exist. More recently, bequests to St Anne’s have accounted for more than half the income donated to the College over the last decade. Between 2014 and 2020, close to £4.8m was received in legacy gifts, financially supporting undergraduates and postgraduates, endowing teaching posts, and contributing to our library and other building projects. Each bequest, however big or small, makes a lasting impact.

By leaving a gift to St Anne’s in your will, you help to provide a range of opportunities for students and the wider college community, securing our future for generations to come. Because St Anne’s is a registered charity, there are also considerable tax benefits to leaving bequests to us. We recognise that you may prefer not to tell us your intentions, but if you let us know your wishes, you will help us to plan for the future and to thank you in your lifetime. You will also be invited to become a member of our Plumer Society which was founded to recognise and thank those generous alumnae and friends who have chosen to remember the College in their will.

View our Legacy Brochure for more informationHow you can make a lasting difference by including St Anne’s in your Will

If you are writing a new Will, or amending an existing Will, St Anne’s can be listed as one of the beneficiaries. Once you have made the decision to leave a gift, it is a straightforward process. We would recommend using a solicitor to write your Will, to make sure it fully reflects your wishes and is legally compliant.

Many alumnae and friends choose to leave an unrestricted legacy for the College’s general purposes. This allows St Anne’s to use your legacy gift in the most effective way, and to respond to future challenges.

We also understand that you might wish to support specific aspects of College life that reflect your own interests and priorities, such as student support, infrastructure or teaching.

Write Your Will for Free

St Anne’s has partnered with Octopus Legacy to offer our alumnae and friends a free will writing service. Having an up-to-date will is the only way to make sure that the people and causes you care about are looked after when you’re no longer here. The online service is available for those in England and Wales, and the offline service but Octopus also offer an over-the-phone/ in-person will-writing service which covers the whole of the UK (including Scotland and Northern Ireland).

This service is absolutely safe and secure, with no obligation, though we do ask that you consider remembering St Anne’s in your will. If you chose to, please let us know, so that we can say thank you.

If you would prefer to talk directly to a solicitor, you can call the Octopus Legacy Team on 0800 773 4014, and quote ‘St Anne’s College’. Alternatively, click on the link below to write your will online.

An alumna (2016) of College used our service and offered this feedback:

“I found the process with Octopus Legacy very simple to follow and everything made sense. I had a small query and the Octopus team responded quickly and helpfully. I am very pleased to have seen St Anne’s advertising the service and would recommend it to other alumnae. Although there is absolutely no pressure to leave a gift for St Anne’s in your will, I was very happy to do so, and this means that I am now a part of the St Anne’s legator circle: The Plumer Society.”

Leaving a Legacy: Rachel Bowden

Although she won’t be around to see how her legacy gift contributes to the future of St Anne’s, knowing that the college would benefit after her death gave my mother much pleasure during the later years of her life. Choosing St Anne’s as one of her charitable beneficiaries was not a difficult decision – St Anne’s had given her the opportunity to shape her own future and she was as proud of her own academic achievements, after lacklustre school years, as she was of her college for believing in her and giving her the chance to fulfil her potential. My mother grew up in a family, and in an era, where, academically, expectations for daughters were not set that high. She was always very grateful to St Anne’s that, as a slightly mature student, having trained and practiced as a nurse for 4 years after school, with a proven academic track record but not necessarily the required qualifications, the college offered her the chance to reshape her horizons. She was exceptionally happy while at Oxford, making lifelong friends and meeting her husband. Oxford also opened up countless opportunities for her.

of her own academic achievements, after lacklustre school years, as she was of her college for believing in her and giving her the chance to fulfil her potential. My mother grew up in a family, and in an era, where, academically, expectations for daughters were not set that high. She was always very grateful to St Anne’s that, as a slightly mature student, having trained and practiced as a nurse for 4 years after school, with a proven academic track record but not necessarily the required qualifications, the college offered her the chance to reshape her horizons. She was exceptionally happy while at Oxford, making lifelong friends and meeting her husband. Oxford also opened up countless opportunities for her.

The love of learning that Rachel gained while at St Anne’s stayed with her for life. Throughout that life, my mother tried to support and promote the chances of those who did not have the good fortune afforded to her. She saw a good education as the biggest privilege you could have, and never stopped learning new skills. Much of her life was devoted to teaching, and she ensured our education was as good as possible. Her gift to St Anne’s can be seen as an acknowledgement that the college gave her the opportunity to learn and to broaden her horizons. Hopefully, her donation can help to pave the way for others to benefit from a similar experience. Her time at St Anne’s was pivotal in her life and she wanted to say thank you in her own modest way.

Rebecca Bannatyne, daughter of Rachel Bowden

Suggested wording for your Will to benefit the College:

“I give the whole or a %...... share of the residue of my estate/or free of tax the sum of £…....... (in figures and words) to St Anne’s College in the University of Oxford (Charity No. 1142660), to be endowed to support its general charitable purposes* and I declare that the receipt of the Principal or other duly authorised officer shall be a full and sufficient discharge of my Executors.”

* If you would like to support a specific subject, project or area of St Anne’s College please contact Dr Stacey Kennedy, Development Manager, on stacey.kennedy@st-annes.ox.ac.uk or 01865 284622 for more information

Tax Benefits

All legacies and bequests to the College are free of UK Inheritance Tax, by virtue of the College’s charitable status. The inheritance tax threshold for your whole estate is reduced from 40% to 36% if you choose to leave 10% or more of your estate to charity.

For international tax efficient ways of leaving a gift in your will, please see the International Giving section below for further information.

Deed of Variation

If you are a beneficiary of a Will, you can transfer all or part of your inheritance to the College under a Deed of Variation. Gifts transferred in this way are free of Inheritance Tax, meaning that St Anne’s College could benefit during your lifetime.

Please consult our brochure for further information.

Transfer of Shares, Land and Property

When quoted shares and securities are transferred to the College, UK income tax relief can be claimed by the donor for the full market value of the gift at the time of transfer, in addition to relief on any existing capital gains tax payable. This enables those holding shares with large capital gains to make a major donation to the College in a cost-effective way.

Further details on Deeds of Variation and transfer of shares, land and property can be obtained through a solicitor.

Case Study: Mary Kearsley

The legacy of Mary Kearsley, St Anne’s first Mathematics Fellow, helped create the St Anne's Mathematics and Computer Science Fund.

Around half the annual income goes towards teaching and helps fund a tutorial fellowship, ensuring the future of mathematical sciences at St Anne’s. The other half provides support for students, enhancing their learning experience and giving them opportunities to make the most of their time at Oxford.

With the support of the Fund, Will Bell, a St Anne’s student (Computer Science), travelled with the Oxford Entrepreneurs Society to San Francisco, during his time as an undergraduate.

Since leaving St Anne’s, Will has gone on to set up his own company. Just three years after graduating, he now employs 15 people, including some St Anne’s graduates. His success demonstrates the impact a funded opportunity can have on a student’s future career.

Case Study: Rosemary Pountney

Rosemary Pountney left a legacy to St Anne's which has allowed us to fund the Rosemary Pountney Junior Research Fellowship. A recent postholder, Hannah Simpson, writes:

"The Fellowship is allowing me to work on three main theatre research projects. I’m finalising a monograph on the staging of physical pain by post-WWII Francophone playwrights, and I’m midway through a second monograph on Samuel Beckett and contemporary disability performance. I’m also beginning work on a new project, looking at the forgotten or ‘unexpected’ plays of modernist authors we more typically consider novelists: Virginia Woolf, E. M. Forster, George Orwell, Flann O’Brien, James Joyce, and Elizabeth Bowen. As an early-career researcher in the present job market, the opportunity to work on these large-scale projects is invaluable. At a moment when we’re seeing English and Theatre departments cut across the country, to the detriment of students and scholarship alike, the Rosemary Pountney Fellowship testifies to the value of continued and properly supported theatre research and teaching."

Pictured: Dr Hannah Simpson

Recognising your generosity

If you wish to support St Anne’s in this way, we would like to thank you properly for your generosity and to invite you to special events, as well as keeping you informed of our current priorities. Close to 250 alumnae have kindly let the College know they have included St Anne’s in their Will.

If you choose to let us know your plans, we will treat your information in the strictest confidence.

Wherever possible and in accordance with your wishes, St Anne’s would like to acknowledge the generosity of your bequest. Fellowships, bursaries, scholarships and physical spaces could be named in recognition of your gift. We would be pleased to discuss options with you.

If you would like further information or a confidential conversation, please contact Stacey Kennedy, Development Manager, by phone on +44 (0) 1865 284622 or stacey.kennedy@st-annes.ox.ac.uk

International Giving

American Friends of Oxford

US alumnae can leave a gift in their Will using the same wording as above, but should include ‘St Anne’s College in the University of Oxford, UK’ as the beneficiary. US tax payers can also receive Estate tax deductions by making a Legacy gift through the University of Oxford North American Office here.

Oxford China Office

Alumnae based in Hong Kong and China who want to give to St Anne’s, either in their Will or during their lifetime, can do so via the Oxford China Office here. Please state clearly that your gift is for St Anne’s College.

Swiss Friends of Oxford

Swiss alumnae wanting to leave a gift in their Will can do so tax-free via the Swiss Friends of Oxford University. See here for more details.